|

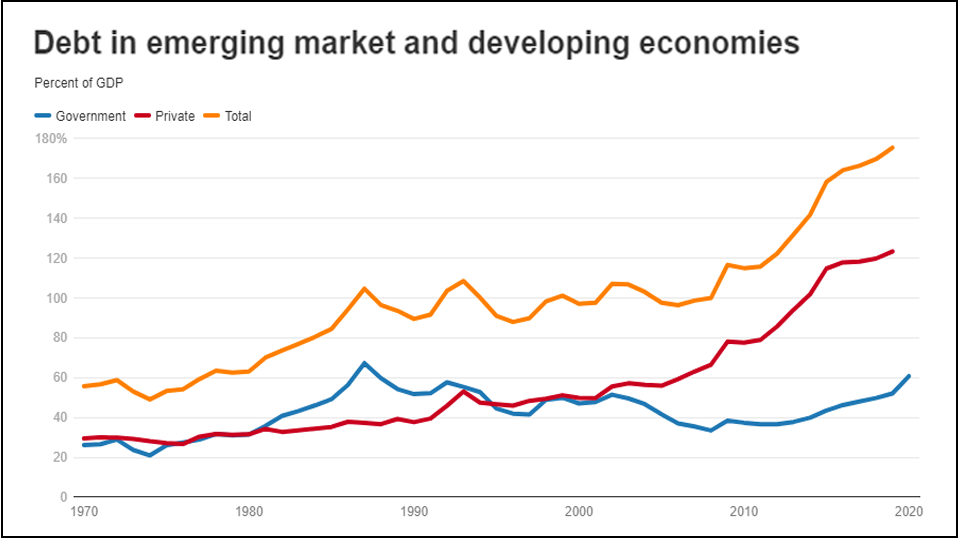

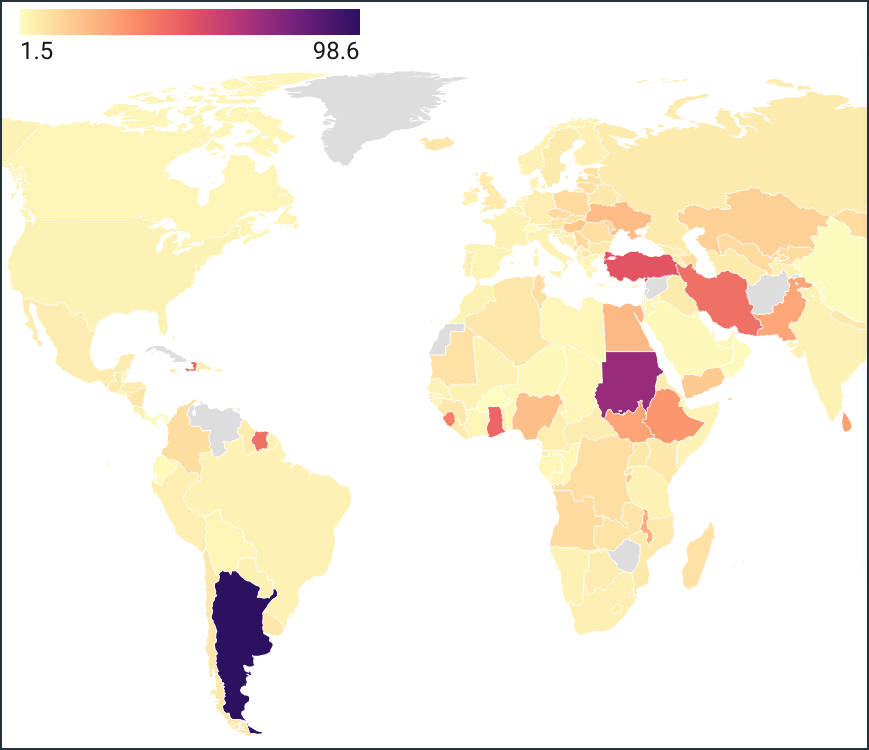

The recent bank failures and debt ceiling crises has shone on light on issues in the American economy. What has been largely ignored, however, is the effect a potential global economic or financial crisis would have on developing countries, who would both be most affected as well as least prepared to respond. Guancha recently sat down with Li Yuefen, Senior Advisor on South-South Cooperation and Development Finance at the South Centre, to discuss this important issue. She had served as the UN Independent Expert on Foreign Debt and Human Rights, and has worked for the UN Conference on Trade and Development for more than 24 years. She also shared her views on development financing, "debt traps" and de-dollarization. Guancha's interview of Li Yuefen Below is a lightly edited transcript of this interview: Guancha: Ms Li, what has been the greatest challenge in your work as senior advisor on South-South corporation and development finance? Li Yuefen: Well, I think the emphasis of my work is still on research and analysis. That is, to follow the recent, most up to date developments in the world, especially in the developing countries, and also the challenges facing the developing countries in terms of South-South cooperation, economic development, development finance. As you've heard, we prepare research papers, policy briefs and brief delegations in Geneva, sometimes New York, on the most recent developments. That's regarding research and analytics. We also provide advisory services to the diplomatic corps in Geneva and sometimes in New York, which means we assist them in their negotiations in the areas of trade, finance, development and in various institutions in WTO, in the United Nations conference on trade and development, in WHO, WIPO and human rights, on various fronts, mostly in Geneva. Sometimes countries would approach us for advice on some of their national challenges, the strategies they are discussing, and the advice they would like to seek. That's advisory service and negotiations. We also implement and undertake technical assistant projects. For instance, we assisted one member country to set up the South-South and triangular cooperation institution in their country. That's quite a complicated process, because we need to do the feasibility study, analysis of their current institutional setup, the current weaknesses and gaps in the country on the front of South-South and triangular cooperation, and also help them to design, if they want to set up an institution, what ? interfaces would be required with other institutions, other ministries in the country, and within what legal and regulatory framework, as well as various related issues. This was a complicated technical assistant project. And for these projects, we very often cooperate with other institutions like regional development banks and United Nations system institutions. For instance, last year we implemented a project with the Food and Agricultural Organization based in Rome. We have different kinds of projects ongoing, sometimes it could be very short, like a one-off seminars. Yuefen Li at a 2019 UN subforum on South-South and triangular cooperation (PHOTO/South Centre) Guancha: You mentioned development financing. We know that one issues developing countries are faced with is the lack of financing. How important is financing for development? What are some ways developing countries have worked to grow financing? Li Yuefen: I think development financing is extremely important for developing countries because of their development stages. There has been, and I think will be a big financing gap for developing countries. There are various kinds of assessment of the size of the gaps, some say developing countries would require one trillion dollars a year in order to fulfill or implement the SDGs. The financing gap is inherent and it is huge. For developing countries to create or mobilize financial resources via organic economic GDP growth, it would be very difficult, it would take a very long period of time and it would really delay tremendously the catching up process with the developed countries. Traditionally, to a lesser extent now, countries relied on official development assistance. We call that in brief ODA, which goes through fluctuations and volatility, as well as various kinds of diversions. It's called development assistance, but it may not really be channeled to development. In the past, especially some least developed countries rely a lot on this ODA and we call that aid reliance of these countries. They depend on ODA for filling their financing gap as much as possible. But we know nowadays there are various kinds of ODA diversions. For instance, with the Ukraine war, the developed countries use a lot of ODA for accommodating refugees in their own countries, which means ODA actually is spent within the developed countries for, to some extent, geopolitical purposes, it's not directly for economic development of developing countries at all. From 1996, when we had the heavily indebted developing countries debt relief initiative, followed by another initiative where the major donor countries provided funds to the international financial institutions to provide multilateral debt relief. After that, there was a tremendous change from the donor countries. Major donor countries basically stopped or drastically reduced their bilateral ODA. Some countries pronounce very clearly we are no longer bilateral donors. About the same time, international financial institutions encouraged developing countries to tap into the international capital market. The credit rating agencies also started to give higher sovereign ratings to developing countries, and financial institutions started to take on more risks, to lend to countries, even to those without a credit rating. With the great push and pull for tapping into the private capitals, some of the frontier economies, for instance, African countries, they've started to float sovereign bonds, starting to borrow heavily at the international capital market. At that time I was working in the United Nations Conference on Trade and Development. I had meetings with some of the ministers of finance of African countries. I said, you need to be careful when you borrow so heavily, you need to think about whether or not you would have the capacity to service this debt. But that was the time when the Bretton Woods institutions encouraged these countries to develop their financial market and also go international. It's difficult to resist the trend, many countries started to borrow heavily. Some developing countries have also started to borrow domestically, so they've accumulated big domestic debt. If you look at the debt composition of low income countries, you will see that for them, domestic debt constitutes about 50% of the total debt of some countries. Debt in emerging markets and developing economies (IMAGE/World Bank) Guancha: There are frequent rumors on Western media of China’s so-called “debt trap diplomacy”. What does the reality of Chinese lending look like? Li Yuefen: I think especially for me, who has worked on the debt issues for a few decades, I see this opinion shaping thing happening. I've also seen it gradually being corrected. It started at the very beginning with the Sri Lanka port incident, involving misinterpretation or misreporting, because it was covered in the news media that China took over the port for 99 years. That was a shock to the world and also to the people working on the debt issues. Gradually you've seen some of the report coverage about China using debt as a means to grab strategically important assets of debtor countries. Then there was this discussion about whether or not China has been using debt as an instrument to create a “debt trap” for countries in order to push for their foreign policy. The media coverage sometimes doesn't really correspond to the realities happening in the world. In the recent 2 or 3 years, you've seen very solid studies and papers based on empirical research to say, very clearly, that up to now, they haven't seen one incidence of China taking over, grabbing asset of debtor countries. In Sri Lanka, clearly it was not like that. It was very important for them to get the financing and to bridge their gap. For a few countries, I've seen papers with tables of the claimed grabbing of assets by China through creating this debt trap, where each column said the fact was not like that, it was proved, and had not been correctly reported. It's difficult for a country as China with different sources of lending, private, bilateral, public, to purposely, coherently create a debt trap. I don't see that China has this ? capacity. And I have not read clear, defined Chinese policy for this debt diplomacy. I think there are rooms for improvement for Chinese lending to developing countries. For instance, for a development banks, regional development banks, or world bank, if they have a big project, they would carry out a very detailed feasibility study and look into the social aspects, cultural aspects, economic aspects, ecosystem, which means whether there is a climate change effect from this project. I think for China, when they undertake infrastructure projects, it would be good to conduct very detailed feasibility study to study all kinds of factors before starting the project, and also do a good analysis of the ability of the country to pay, the revenue situation, balance of payment situation, and the entire GDP trajectory, to see whether the country has the ability to absorb the debt created by various projects or different kinds of lending for different purposes. I see room for improvement, for transparency, but I also see that the current discussion has been tinted by the current geopolitical debate in the world. Objectivity is extremely important for economic studies and also for media coverage when it comes to issues like debt. I've just been to the World Bank Spring Meeting, and I still see that this objectivity is not being fully reflected and the discussions have sometimes been distracted by geopolitical concerns. And as a result, the most important issues, for instance, the reform of the international architecture on debt has been omitted or not given enough attention. Hambantota Port file photo Guancha: In order to combat inflation and stop the formation of financial bubbles, many developed countries, namely the US, have rapidly hiked their Central Bank interest rates. How has this affected developing countries? What can developing countries do to mitigate any adverse effects? Li Yuefen: I think this is a terribly important issue for developing countries. First of all, I must say that monetary normalization is necessary. However, with regards to the rapid interest hikes we’ve been facing recently, I think that requires more coordination among the major systemically important countries and also communication with the developing countries. The spillover effects of these ? rapid hikes of interest rates are ?enormous on the developing countries. We've seen that inflation has hit many developing countries. In some countries, it’s triple digits, surpasses 100%, 200% and double digits inflation in many developing countries. Massive currency depreciation has been happening in quite a number of developing countries, which means debt servicing cost has been increasing tremendously. So you see quite a number of developing countries are facing balance of payments problems, and also their fiscal position has been deteriorating quickly. In some countries, for instance Sri Lanka, the foreign exchange reserves has been completely depleted, and drastically reduced for many other countries. People in developing countries are suffering because of the interest hikes, and poverty has increased. Inflation actually would touch upon the major items, food items that the poor people would have to really consume every day. So it's a major cause of increasing poverty. The repercussion, the spillover effect has been widespread and also quite dramatic. I think this is a big challenge for the developing countries, and we see that an increasing number of countries will be facing the problem of default. That is, they will not be able to service their debt and they have to declare bankruptcy at a sovereign level. That will be a global systemic challenge. Inflation rate in April 2023 (IMAGE/JJLiu112) Facing this situation, what can the developing countries do? First of all, we know that countries with good economic fundamentals suffer less. The countries with weak economic fundamentals, they plunge into crisis. For these countries, it's important for them to look very carefully at their fiscal position. I would not recommend austerity because people are already suffering a great deal. I think they should try to introduce preemptive measures to maintain financial stability in the country as much as the country can. Capital control is one measure that countries can use. Because of interest rate hikes, capital has been flying out of developing countries and going back to the developed countries. Whenever it's necessary and possible, capital control is one measure that countries can use to lessen or mitigate the financial volatility in the country. And of course, social safety net is important. Whenever the fiscal position allows, the government should consider how to introduce targeted social service for the vulnerable population in the country. Internationally, developing countries should unite and request for international financial support, for instance, floating SDRs in the IMF, as well as mobilization of resources from regional banks and from the private sector to assist these countries. And necessary swap lines among central banks would be important to be established or expanded to mitigate financial volatility once it happens; for developing countries, the swap line already in existence is very small. There are various kinds of measures they can think about, but they need to adopt these measures preemptively to ward off the crisis that will be coming. Guancha: Partly as a result of this, a number of major banks have run into significant difficulties, including Credit Suisse here in Switzerland. What effect do you think this will have on financing in developing countries? How can developing countries prepare for these effects, as well as prevent banking crises in their own country? Li Yuefen: For the recent bank failures, one very important warning to other countries is that banks should be well regulated and there should be transparency. When the banks put all the eggs in one basket, they don't have good risk management. The banks should be always aware of the third party risk, for instance Credit Suisse and the Silicon Valley Bank. For the Silicon Valley Bank, one important thing is the mismatch in the maturity of their assets. For instance, they use short term deposits for long term instruments, and in the end, when there are interest rate hikes, there is a run on the bank. Proper regulation, proper transparency, so that the authorities and even ordinary citizens know what is happening will be very important for the banking sector and also for the financial sector of an entire country. This is an important lesson. Silicon Valley Bank declared bankrupcy on March 10th (PHOTO/Getty) Also, through the bailing out, or through the rescue of these two banks, we can also see the big challenges facing the developing countries. You can see very clearly that the two banks, within two or three days, they could raise hundreds of billions of dollars through swap lines. In the US, the swap line is huge on a daily basis. When I went to the Washington Spring Meeting, the developing countries were saying, the US can raise hundreds of billions of dollars and save the bank within three days, while for developing countries, once they face financial difficulties, three years they don't see things moving. Here we can see the asymmetry in the liquidity provision to developed countries and the liquidity provision to the developing countries. Big difference. This is an important issue and also shows the need for the reform of the international financial architecture. You see the need to increase the voices and the representation of developing countries in the decision process of the international financial architecture. This is a very important time to raise this issue because many developing countries are facing lots of problems. The close monitoring and regulation of the banking sector is very important, it rings a warning bell for developing countries to watch out and pay attention to possible similar banking problems that could happen to their own financial sector. Guancha: In recent weeks, efforts to achieve “de-dollarization” appear to be gaining steam. Russian president Putin recently pledged to adopt the RMB for payments between Russia and much of the Global South. During his visit to China, Brazilian president Lula publicly questioned why we can’t use our own currency in trading that doesn’t concern the US. Even France just conducted its first LNG sale in RMB. What do you think is behind this push for de-dollarization? What do you think is its prospect in the short term? What about the medium to long term? Li Yuefen: I think the recent developments have shown that dollarization for all these past decades have a lot of problems especially for developing countries. The US dollar, as an international reserve currency, has exorbitant benefits for the country. When countries really do have dollarization in their particular countries, they actually lose sovereign control of their monetary policies, completely giving it away, which means their monetary policy depends on the US dollar. For the running of the economy, it’s a huge disadvantage at times of crisis Being an international civil servant working on the financial areas, for years we've been discussing the issue of possible de-dollarization. However, there are lots of challenges for de-dollarization. I myself would hope that people would not have high expectations for a quick de-dollarization process, because right now, for instance, the SWIFT system, the clearing system for trade and banking sector, is completely dominated by the United States. Of course, we also have other system there, but it plays a minor role. The clearing system itself is hugely important. And if you want de-dollarization, and you cannot solve the clearing system, it won't be happening. SWIFT logo at its Belgium HQ (PHOTO/Pengpai) We know that the European union tried to set up another clearing system (INSTEX). It has gone to certain stages, developed for several years. But, from what I read, largely owing to resistance from the United States, they have stopped this initiative, anyways I haven't seen any progress going on. On the whole, you need also to have other financial infrastructure in order to materialize the de-dollarization. That would take time to develop. And most importantly, there is the United States. I don't see the US viewing this positively, and there is huge political resistance and material resistance in various ways. I don't want to mention what ways, you can think about that, and you know they exist. I see it as something that we should work on very hard together, and I also see tremendous challenges. I hope experts, countries would also take into consideration of the needed infrastructure in order to allow the de-dollarization to happen. That requires a lot of work and also requires a lot of financial resources, a lot of human resources, and a lot of expertise. Let’s hope countries can work together and overcome various kinds of resistance. It won't be an easy job, but it doesn't mean that it will not happen. We should aim for the long term, because it would really take years. It won't happen next year certainly. Interviewer: Jersey Lee 本文系观察者网独家稿件,文章内容纯属作者个人观点,不代表平台观点,未经授权,不得转载,否则将追究法律责任。关注观察者网微信guanchacn,每日阅读趣味文章。 |

Guancha's Interview with Li Yuefen:The Debt Situ

时间:2024-03-26 16:27 来源:网络整理 转载:我的网站

- 上一篇:提醒!长春多家超市恢复室内营业

- 下一篇:紧要!肇庆有三人被空军录取!