|

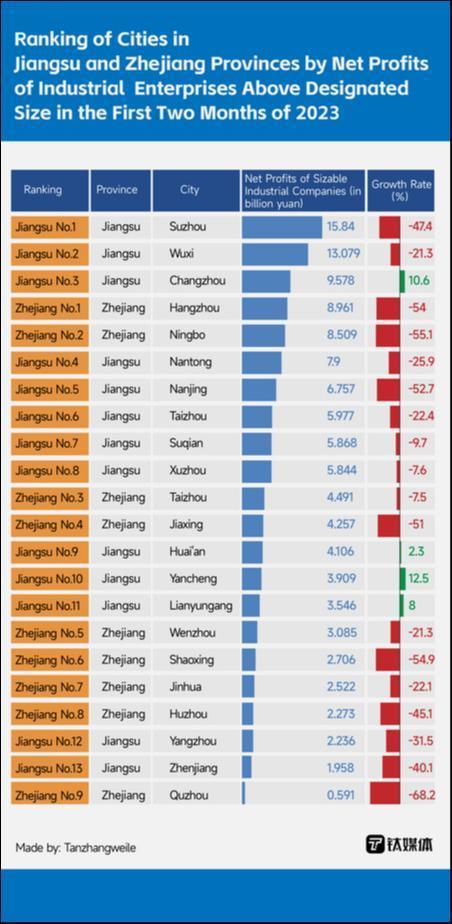

BEIJING, April 4 (TMTPOST) – A?table of the?ranking of cities in Jiangsu and Zhejiang?circulated on the Internet?shows?that 71% of the 21 prefecture-level cities experienced a year-on-year drop of more than 20%?in industrial profits?of sizable industrial enterprises. Among them, six cities?witnessed a?decrease?of over 50%?in their profits,?such as Quzhou, whose profits fell by as sharply?as 68.2%. The accuracy of the table is not confirmed?due to the lack of official?data sources. The National Bureau of Statistics actually does not publish data on industrial revenues and profits in cities below the provincial level, and Zhejiang and Jiangsu provinces didn’t release their industrial profit data by city either. However, according to official data released by the National Bureau of Statistics, industrial profits in Jiangsu and Zhejiang did drop significantly in January and February 2023, i.e.?25.8% and 48%,?respectively. The decline in industrial profits in the two provinces was?worse?than the national average.?Zhejiang’s economic situation, especially in the manufacturing sector, was even more severe, with lower growth in industrial value added and retail sales of consumer goods than those?in Jiangsu. The declining industrial profits in Jiangsu and Zhejiang provinces were?indicative of China’s economic system and macroeconomic conditions. The main contributing factor to the decline was?the sharp deterioration in exports, which was?not unique to the two provinces but also observed in other traditionally large export regions like Shanghai, Guangdong, Fujian, and Shandong. The slowdown in overseas demand has resulted in a rapid fall in China’s exports. Among the top 10 provinces and municipalities?in terms of exports, Zhejiang has the highest degree of reliance on exports, i.e.?41.3%. Therefore, the revenues for Zhejiang enterprises were?hit?the?worst. Another contributing factor is the concentration of resources in?state-owned enterprises. More resources have?been allocated to state-owned enterprises?in?recent years, particularly?during the post-pandemic?economic rebound?period from December 2022 to February 2023. An increase in resource allocation to state-owned enterprises?would inevitably result in a decrease for the private sector. Zhejiang and Jiangsu host the largest number?of private enterprises in China, with Zhejiang having a larger proportion of private enterprises. With?domestic demand?going up again, the profit growth rate of enterprises in Jiangsu and Zhejiang may gradually bottom out, indicating that the worst time?may be passing. The manufacturing PMI have recently exceeded market expectations, staying?in?the expansion range?for three consecutive months.?The non-manufacturing PMI continued to surge?to?a 10-year high. The current issue of declining corporate profits can be addressed by improving?domestic demand,?taking?practical measures, and avoiding overstating pessimism. Additionally, it should be noted that corporate profits are highly leveraged and prone to booms and busts. The top priority?nowadays is to ensure?stable economic growth. |

Most Manufacturers in China's Economic Powerhous

时间:2024-02-14 06:08 来源:网络整理 转载:我的网站