|

Burgundy Private Hurun India 500 2021

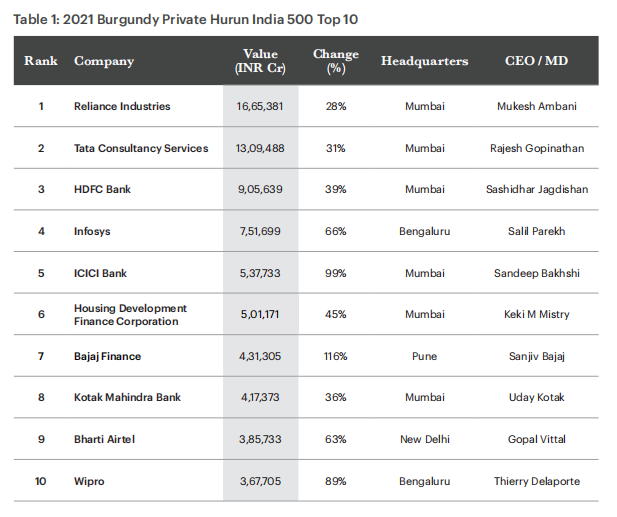

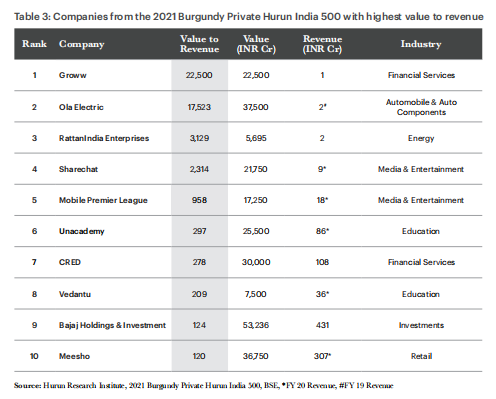

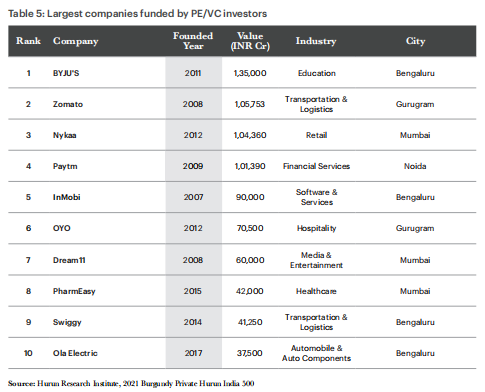

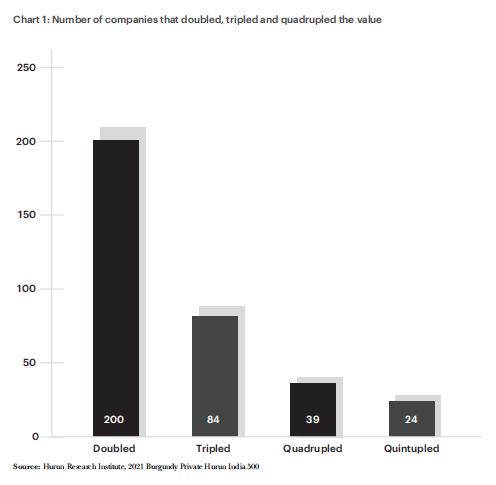

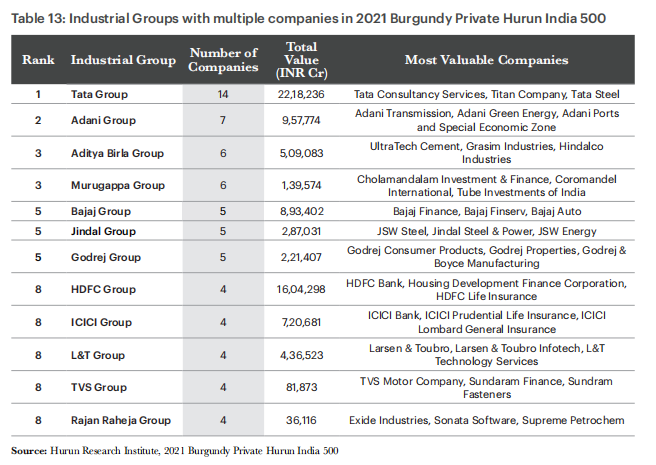

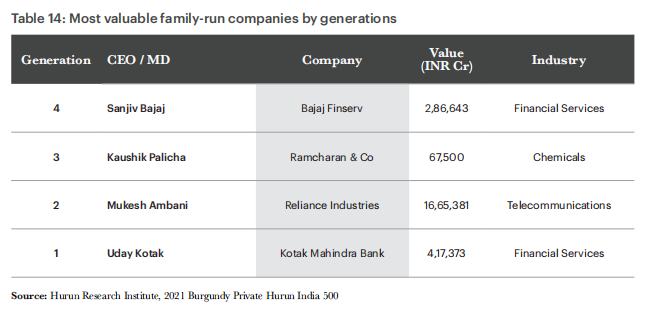

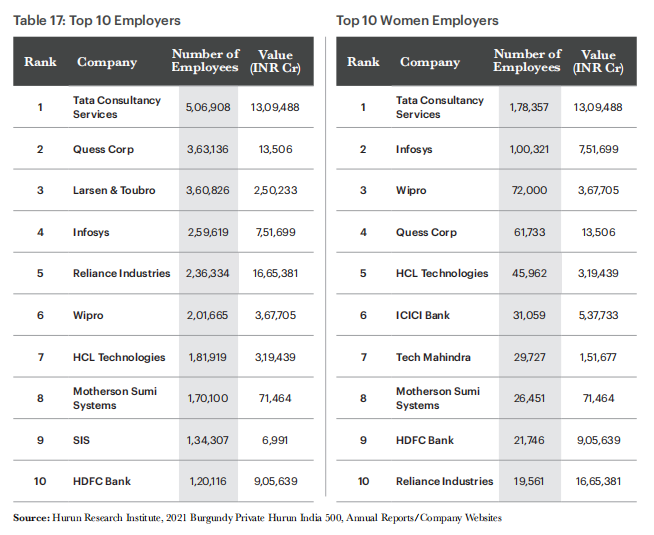

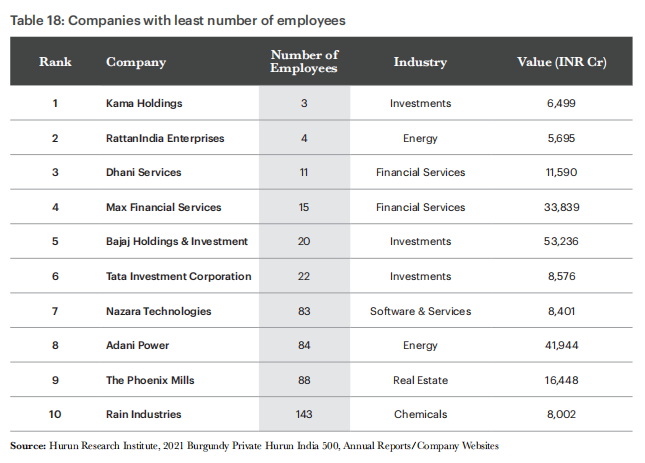

Despite the Covid-19 Pandemic, the cumulative value of the 2021 Burgundy Private Hurun India 500 companies grew by 68% YOY to an average of INR 45,300 crore. 461 companies saw their value increase, of which 200 of them doubled in value. 20 companies rose by INR 1 lakh crore, led by Reliance Industries, TATA Consultancy Services, Infosys, and ICICI Bank Big 3: With a value of INR 16.7 lakh crore, Reliance Industries is India’s most valuable company, followed by Tata Consultancy Services with INR 13.1 lakh crore and HDFC Bank with INR 9.1 lakh crore Covid-19 vaccine producer Serum Institute of India increased its value by 127% to INR 1.8 lakh crore and is India’s most valuable unlisted company Value creation at historic highs: total value of 2021 Burgundy Private Hurun India 500 companies is INR 228 lakh crore (US$3tn), more than India’s GDP in 2021 at current prices The companies on this list came from 43 cities across India, led by Mumbai (167), Bengaluru (52) and Chennai (38). These 3 cities contribute to more than half of the 2021 Burgundy Private Hurun India 500 list Financial services and healthcare led the way with 77 and 64 companies respectively, followed by chemicals with 42 entrants Total sales of the 2021 Burgundy Private Hurun India 500 companies cumulated to INR 58 lakh crore, equivalent to 26% of India’s GDP The 2021 Burgundy Private Hurun India 500 companies employ 69 lakh people in total, with an average of 13,800 employees The 2021 Burgundy Private Hurun India 500 list of companies contributed INR 1.9 lakh crore, nearly 62% of the corporate income tax collection in FY 2021 The average age of companies in this list is 39 years, i.e., founded in 1982 52 companies are younger than 10 years, led by Mensa Brands - the youngest company to feature on the list, founded just 6 months ago 21 companies are older than 100 years, led by Forbes & Company founded in 1767 The 2021 Burgundy Private Hurun India 500 companies collectively spent INR 7.0 lakh crore last year on employee benefits Women constitute 16% of boards of the 2021 Burgundy Private Hurun 500 companies Driven by the rise in retail trade, India’s no.1 stock exchange, National Stock Exchange, saw its value grow by 42% to INR 1,68,200 crore. 80% of derivative trading orders are made through NSE 44% of 2021 Burgundy Private Hurun India 500 companies are run by professional CEOs 44% of the companies on this list sell services, 56% sell physical products 71% of the companies are consumer-facing, 29% are B2B 53 companies are also featured in the Hurun global unicorn list 2021, led by BYJU's, InMobi, and OYO December 9, Mumbai:Burgundy Private, Axis Bank’s Private Banking Business and Hurun India launched the first edition of the ‘2021 Burgundy Private Hurun India 500’, a list of the 500 most valuable companies in India. These companies are ranked according to their value, defined as market capitalization for listed companies and valuations for non-listed companies. The cut-off date to arrive at this list was 30th October 2021. This list refers to companies headquartered in India only; state-owned companies and subsidiaries of foreign companies are not included. To make it to the ‘2021 Burgundy Private Hurun India 500’ list, companies require to have a minimum value of INR 5,600 crore, equivalent to US$ 750 million. On an average, companies from this list were founded in 1982 and are worth a total of INR 228 lakh crore (US$3tn) today, up by 68% YoY. Surprisingly, there has been no slowdown in a year dominated by Covid-19. Both the BSE SENSEX and NIFTY 50 rose by more than 50% YOY, whilst the S&P BSE 500 was up 69% over the same period last year. Amitabh Chaudhry, Managing Director and Chief Executive Officer, Axis Bank said:“Burgundy Private is delighted to partner with Hurun India in celebrating India’s 500 most valuable companies. We salute the leadership of these companies who have ably steered their businesses through the ravages of the pandemic, adopting new ways of serving their customers and emerging as winners. As India’s leading wealth management franchise, Burgundy Private has witnessed this value creation from close quarters. The total value of the 2021 Burgundy Private Hurun India 500 companies is close to INR 228 lakh crore (US$3tn), which is higher than India’s GDP for FY21. The top line of these 500 companies is equivalent to 29% of India’s GDP and they employ up to 1.5% of the total workforce of the country. What is most heartening is that nearly 10% of these companies are younger than 10 years, representing India’s vibrant tech ecosystem. We believe that India’s new economy companies will witness greater representation in this list in the times to come. Axis Bank has been a partner to many names that find a mention in this report, and through our integrated ‘One Axis’ approach, we look forward to working closely with them as they achieve greater milestones in their journey ahead.” Anas Rahman Junaid MD and Chief Researcher, Hurun India said:“It is easy to see why Burgundy Private Hurun India 500 represents the most powerful group of companies in India. With a total value of US$3tn, which is more than India’s current GDP, they make up the backbone of India’s economy. Together, these 500 companies had combined sales of US$770bn, and employed 6.9 million staff, which is more than the working population of United Arab Emirates. Hurun India is delighted to partner with Burgundy Private, Axis Bank’s Private Banking Business to release the 2021Burgundy Private Hurun India 500.” “The 2021 Burgundy Private Hurun India 500 added US$1.2tn in value. Stock markets rose to record heights on the back of a fast-growing digital economy coupled with increased optimism for the post-Covid growth trajectory of the Indian economy. In terms of fastest-growing industries, Financial Services, Software & Services and Healthcare sector cumulatively added INR 40 lakh crore” “The report also throws insights on the economic winners and losers of Covid-19. The 2021 Burgundy Private Hurun India 500 saw their value go up 68%, or a massive INR 90 lakh crore, to a total of INR 228 lakh crore. Half of that came from companies based in Maharashtra. INR 46 lakh crore came from just four companies, the so-called ‘India’s Big Four’ or Reliance Industries, Tata Consultancy Services, HDFC Bank and Infosys. 14 Tata group companies added INR 8.5 lakh crore and accounts nearly 10% value of the 2021 Burgundy Private Hurun India 500” “India’s most valuable companies keep getting more valuable, with the total value of the 10 most valuable companies rising five times in the last decade.” “Value is perhaps the best way to measure a company’s performance, since value takes into account not just the current performance of a company but also its future potential. Curiously, many of the India’s most valuable companies had surprisingly low sales. For example, Fintech platform CRED, whose sales were only INR 108 crore in FY 21, was worth INR 30,000 crore. Some companies have high sales, while their market value is relatively small.” “Other state governments should take note of the fact that Mumbai is home to 33% of the 2021 Burgundy Private Hurun India 500 and Maharashtra to 40% of the list. What makes Mumbai and Maharashtra different? What should other states and city governments do to attract the 2021 Burgundy Private Hurun India 500 to set up a regional HQ or facilitate the growth of homegrown companies that could feature in Burgundy Private Hurun India 500?” “271 companies on the 2021 Burgundy Private Hurun India 500, which is ranked by value, are not on the 2020 Fortune India 500, which is ranked by sales. The difference came from Hurun excluding companies like Reliance Capital or Future Retail, which had large sales but did not generate enough value to take them over the INR 5,600 crore threshold. Another reason is that the 2021 Burgundy Private Hurun India 500 does not include state-owned companies like State Bank of India and Oil and Natural Gas Corporation. 51 listed state owned companies would have achieved the threshold valuation, of INR 5,600 crore, to feature in 2021 Burgundy Private Hurun India 500.” “Hurun has been promoting entrepreneurship through its lists and research since 1999. Starting with the rich list and philanthropy lists, Hurun has gone on to rank unicorns and recently the 500 most valuable companies, on a global level as well as for individual countries, most significantly China and India” “Regional governments from around the country and beyond are competing to attract the most valuable companies in the country, companies from the Burgundy Private Hurun India 500 list. These companies represent the biggest opportunity for tax revenues, quality employment and industry leadership” “From the 2021 Burgundy Private Hurun India 500, we can see the booming private economy in India. The value of Reliance Industries, for example, has exceeded the combined value of the top ten state-owned enterprises” “The 2021 Burgundy Private Hurun Indian 500 shows the concentration of economic power. Just 500 companies had sales of INR 58 lakh crore between them, equivalent to 29% of India’s GDP last year, employed 69 lakh people, equivalent to 1.5% of India’s total work force and paid 62% of India’s corporate income tax.” “Whilst the valuations of the 2021 Burgundy Private Hurun India 500 might appear at first glance to be huge, it is worth comparing against the Hurun Global 500. Apple’s current valuation is about US$2.5tn, just a little under the total valuation of the 2021 Burgundy Private Hurun India 500. Currently, 12 Indian companies make the 2021 Hurun Global 500, placing India 9th in the list led by the USA with 243 followed by China with 47” “India’s start-ups are producing some significant companies. Just under 11% of the 2021 Burgundy Private Hurun India 500 are less than 10 years old, led by Mensa Brands, Apna, CRED, BharatPe, Mobile Premier League and Zetwerk. Of these startups, 53 are Unicorns and 1 is a Gazelle.” “Women make up 16% of the board of directors from the 2021 Burgundy Private Hurun India 500. As India’s economy grows and Burgundy Private Hurun India 500 becomes bigger, expect this percentage of women board directors to grow too. The 2021 Burgundy Private Hurun India 500 are some of the biggest employers of women in the country, led by Tata Consultancy Services with just under 2 lakh women employees.” “Family businesses still make up the bulk of the Indian economy, with 78% of the 2021 Burgundy Private Hurun India 500 being family-run businesses.” “The 2021 Burgundy Private Hurun India 500 is spread across 25 different industries, demonstrating the overall growth story of Indian economy” “75% of companies featured in the 2021 Burgundy Private Hurun India 500 are exclusively focused on the Indian market, whilst only 25% operate globally.” “A unique feature of the Indian economy is the traditional industrial groups, many of which started over 100 years ago. The top 10 industrial groups between them own 68 companies or 14% of the 2021 Burgundy Private Hurun India 500, led by Tata Group with 14 companies and followed by the Adani Group with 7 and Aditya Birla Group, and Murugappa Group with 6 each.” “The stories of these companies tell the story of the modern Indian economy.”, concludedAnas Rahman Junaid, MD and Chief Researcher, Hurun India. Methodology The 2021 Burgundy Private Hurun India 500 is a list of the 500 most valuable companies that are headquartered in India. Government/ State-owned companies and subsidiaries of foreign companies are excluded. Although the cut-off date for the list is 30th October 2021, we have taken an exception for Paytm, Nykaa, Policybazaar, Sapphire Foods India, Latent View Analytics and Go Fashion for which we have considered the closing market cap of the listing day. The aforementioned companies were in the process of going public/ getting listed during the cut-off date. Valuing private companies is as much an art as it is a science. Surely, Hurun India may have missed some companies, but our endeavor is to develop the most comprehensive report of its kind with an objective to identify and acknowledge India’s top businesses. Hurun Report’s team of researchers have traveled the length and breadth of the country, cross-checking information with entrepreneurs, industry experts, journalists, bankers and other sources of publicly available data. For unlisted companies, Hurun Research’s valuation is based on a comparison with their listed equivalents using prevailing industry multiples such as Price to Earnings, Price to Sales, EV to sales, EV to EBITDA. Other methodologies such as Discounted Cash Flow and Tobin’s Q are also used. In certain cases of early- stage companies, Hurun used the First Chicago Method for valuation. Financial information used is from the latest available annual reports or audited financial statements. About Axis Bank: Axis Bank is the third largest private sector bank in India. Axis Bank offers the entire spectrum of services to customer segments covering Large and Mid-Corporates, SME, Agriculture and Retail Businesses. With its 4,679 domestic branches (including extension counters) and 10,970 ATMs across the country as on 30th September 2021, the network of Axis Bank spreads across 2,658 centers, enabling the Bank to reach out to a large cross-section of customers with an array of products and services. The Axis Group includes Axis Mutual Fund, Axis Securities Ltd., Axis Finance, Axis Trustee, Axis Capital, A.TReDS Ltd., Freecharge and Axis Bank Foundation. For further information on Axis Bank, please refer to the website: https://www.axisbank.com About Burgundy Private – Private Banking by Axis Bank Burgundy Private, Axis Bank’s private banking business, is one of the fastest growing wealth managers in India, managing client assets of over USD 10bn. With access to considerable resources of the Axis Group, Burgundy Private provides bespoke wealth management services along with the power and stability of a leading bank to its private clients. Headquartered in Mumbai, with a 200 strong team, Burgundy Private manages the wealth of more than 3,000 illustrious families across 27 locations in India. The clientele comprises of some of the most distinguished families in the country, including 25% of India’s top 100 families in terms of their net-worth. Burgundy Private brings to its clients a comprehensive platform that provides tailored services across wealth management, investment advisory, family-office solutions, personal & corporate banking, family governance & succession-planning and tax advisory. Burgundy Private offers Investment Advisory and Family Office Services through Axis Securities Limited. About the Hurun Report Hurun Report is a leading research, luxury publishing and events group established in London in 1998 with presence in India, China, France, UK, USA, Australia, Japan, Canada and Luxembourg. It is widely recognized world-over for its comprehensive evaluation of the wealthiest individuals across the globe. Hurun Report is the largest compiler of the rich list globally. Hurun Report Inc. has four divisions: Hurun Report Media, a stable of digital media and four magazines; Hurun Research Institute; Hurun Conferences, an active events division targeting entrepreneurs and high net worth individuals; and Hurun Investments, a USD20m early-stage venture capital fund with investments into tech, media, retail and education. About Hurun India “Promoting Entrepreneurship Through Lists and Research” Hurun India was launched in 2012, under the leadership of Anas Rahman Junaid, a graduate of the University of Oxford. Junaid met Rupert Hoogewerf, the founder of Hurun Global, through Oxford University and the duo thought it was the right time to speak about wealth creation in India as they saw India booming. Since then, Hurun India has been in the pursuit to celebrate the stories of India’s transparent wealth creation, innovation, and philanthropy. The Five core pillars of Hurun India are: 1.Wealth Creation -We celebrate transparent wealth creation by bringing to light success stories of some of the most amazing entrepreneurs through Hurun Rich Lists. ● Hurun India Rich List is a ranking of individuals with a net worth of INR 1,000 Crore+ and has grown to become the most comprehensive rich list from India. Over the last decade, the list grew from 100 individuals from 10 cities to 1,007 richest Indians, from 76 cities. ● Hurun Leading Wealthy Women List is the ranking of the richest self-made women in India ● Hurun Real Estate Rich List ranks the most successful Real Estate entrepreneurs in the country. ● Hurun India Wealth Report is the most detailed Hurun study on the wealth distribution landscape in India. 2.Value Creation -Under this pillar, Hurun celebrates the success stories of some of the most respected Indian companies through Hurun India 500 - a ranking of most valuable non-state-controlled companies and emerging companies and investors that make the future look bright for India through the Hurun India Unicorn Index, Gazelle List, Cheetah List, and Top Investors List. 3.Sustainability and Philanthropy - Hurun India Philanthropy List,which is on the 6th year anniversary, ranks India’s most generous entrepreneurs.Hurun India Impact 50list ranks India’s most sustainable companies based on their alignment with the UN’s Sustainable Development Goals. 4.Art -In 2019, the Hurun India Art List was launched, aimed at tracking some of the most successful artists who are alive today by way of cumulative auction prices. Through the art list, our endeavor is to encourage individuals to collect Indian art. 5.Lifestyle and Luxury-The Hurun Luxury Consumer Survey debuted in 2019 to encourage an understanding about lifestyle and brand preferences of ultra-high net worth individuals, while curating a survey to help them explain their spending habits. Globally, the Hurun brand registers an estimated 8 billion views, 50% YoY growth, on the back of lists and research reports. Hurun India serves as India’s definitive voice celebrating wealth creation, innovation, and growth. Last year, Hurun further expanded its repertoire by releasing the Hurun Global Rich List 2021, a ranking of the 3,228 US dollar billionaires, so-called ‘Nine-Zero Club’, currently in the world and the tenth India Rich List which ranks the 1,007 richest individuals in India, allowing for comparisons between some of the most dynamic economies in the world. The purpose of this list is to try and tell the story of modern India through the eyes of an entrepreneur. Annexure: - Top 10 of 2021 Burgundy Private Hurun India 500 The total value of the top 10 companies grew 47% to INR 72.7 lakh crore (US$970bn), equivalent to 37% of India’s GDP and 32% of the total value of the 2021 Burgundy Private Hurun India 500. 6 are headquartered in Mumbai.

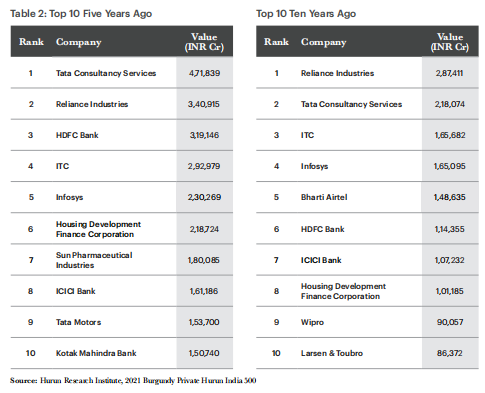

Compared with 5 and 10 years ago? The total value of the top ten most valuable Indian enterprises has increased four-fold in the past decade. Eight companies have made the Top 10 over the past decade. Notable exits from the top 10 include ITC and Larsen & Toubro.

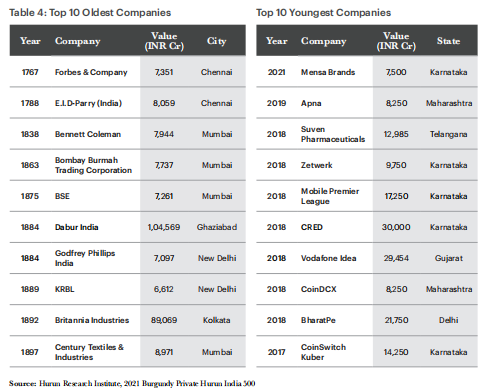

How old are they? The average age was 39 years, i.e. founded in 1982. 21 companies have a history of more than 100 years, of which Forbes & Company and EID-Parry (India) are more than 200 years old. 139 companies were founded in this Millenium of which 52 are less than 10 years old, led by Mensa Brands, Apna, BharatPe, Mobile Premier League, and CRED.

Unlisted companies The 2021 Burgundy Private Hurun India 500 features some of the most valuable unlisted companies too. Serum Institute of India is the most valuable unlisted company, followed by National Stock Exchange of India.

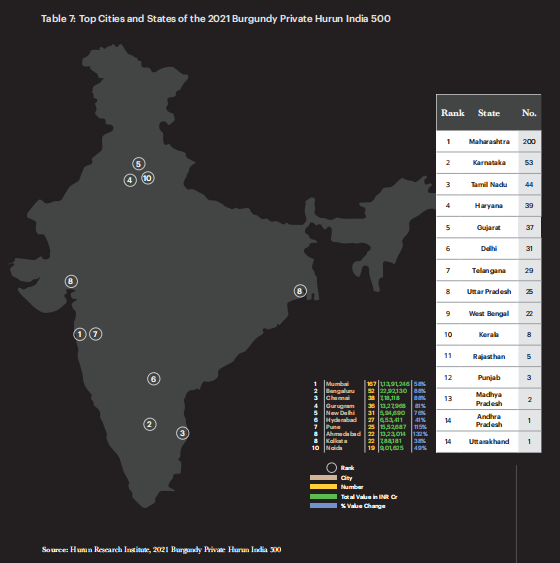

Geographical distribution The 2021 Burgundy Private Hurun India 500 came from 15 states, led by Maharashtra, Karnataka and Tamil Nadu followed by Haryana, Gujarat, and Delhi. By city, Mumbai led with 167, followed by Bengaluru with 52, then Chennai and Gurugram with 38 and 35 respectively.

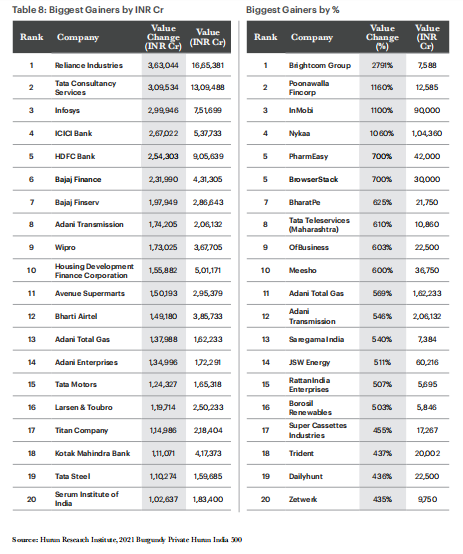

Biggest Gainers In terms of growth, the 2021 Burgundy Private Hurun India 500 was led by Hyderabad-based Brightcom Group followed by Poonawalla Fincorp and InMobi. By absolute value, the biggest gainers were Reliance Industries, Tata Consultancy Services and Infosys.

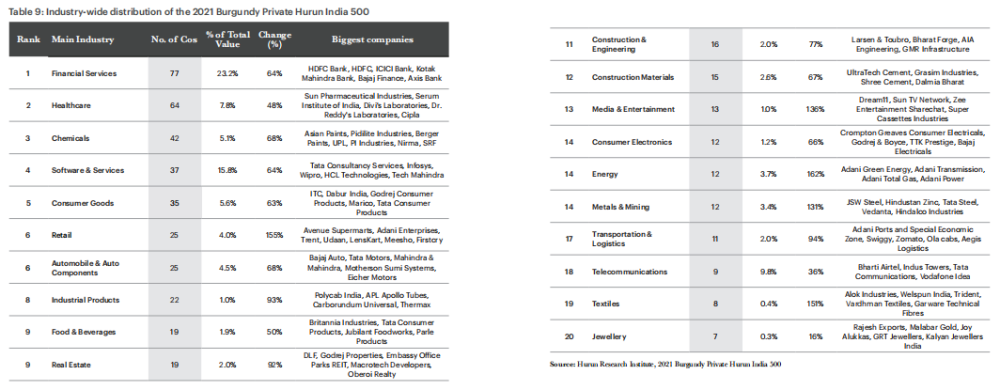

Industry Distribution Financial Services and Healthcare were the biggest contributors to the 2021 Burgundy Private Hurun India 500 with 77 and 64 companies respectively. The Top 5 industries made up half the 2021 Burgundy Private Hurun India 500. In terms of value created, Financial Services led the way with nearly one-fourth of the cumulative value of the 2021 Burgundy Private Hurun India 500, followed by Software & Services (16%), Healthcare (7.8%) and Consumer Goods (5.7%).

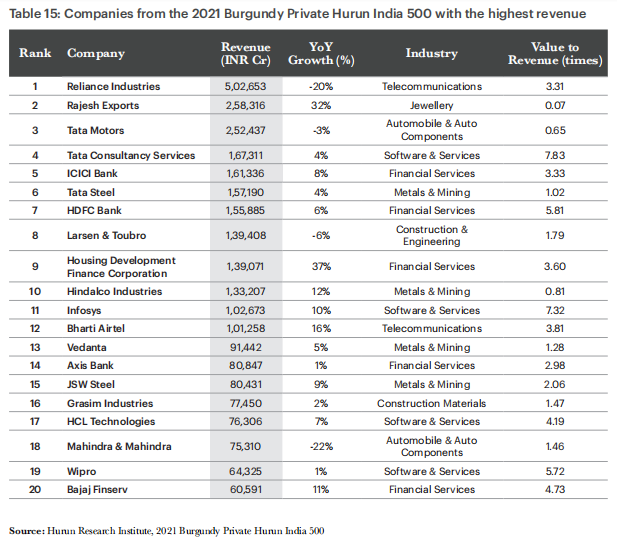

Largest companies by revenue Average sales of the 2021 Burgundy Private Hurun India 500 was INR 12,470 crore. 106 of the 2021 Burgundy Private Hurun India 500 had sales of more than INR 10,000 crore last year, of which 24 companies managed to feature the list with sales of more than INR 50,000 crore in the previous year.

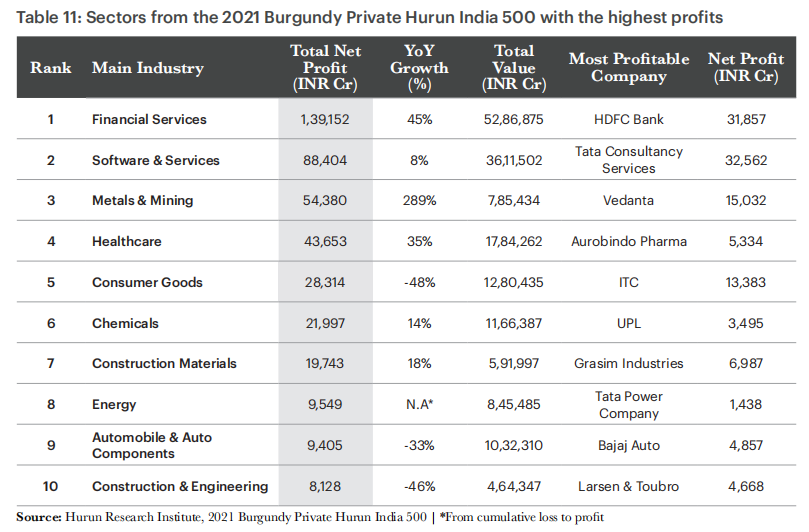

The combined net profit of the 2021 Burgundy Private Hurun India 500 companies was up 44% to INR 4.3 lakh crore in FY21. Sectors such as financial services, software & services, metals & mining and healthcare continued to have rising profits and accounted for more than 3/4th of the profits of the 2021 Burgundy Private Hurun India 500 companies in FY 21.

How many do they employ? Companies from the 2021 Burgundy Private Hurun India 500 employ 6.9 million people, an average of 13,800. 139 have more than 10,000 employees, led by Tata Consultancy Services with 5,06,908 employees and Quess Corp with 3,63,136 employees. 98 have less than 1,000 employees.

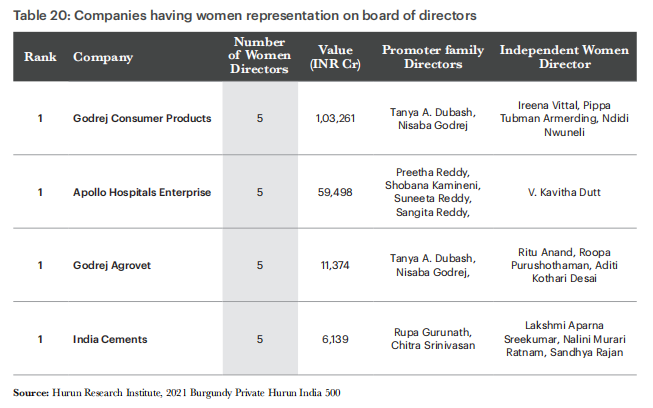

Women representation in boards Companies from the 2021 Burgundy Private Hurun India 500 appointed 644 women directors on board.

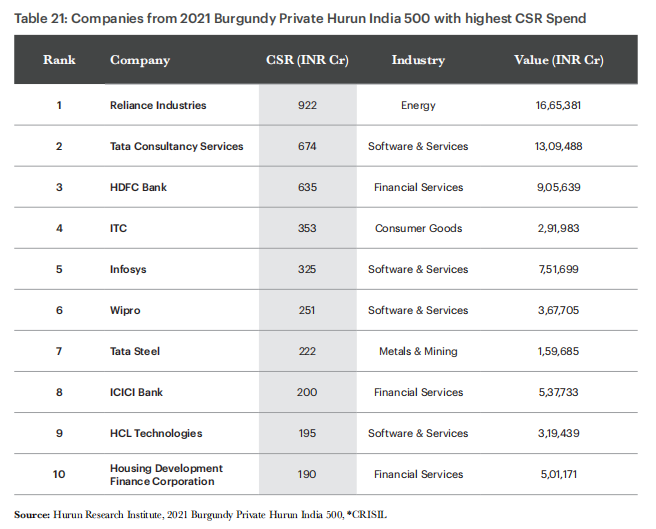

Corporate social responsibility Companies from the 2021 Burgundy Private Hurun India 500 accounted for 40% of total expenditure on corporate social responsibility (CSR) activities.

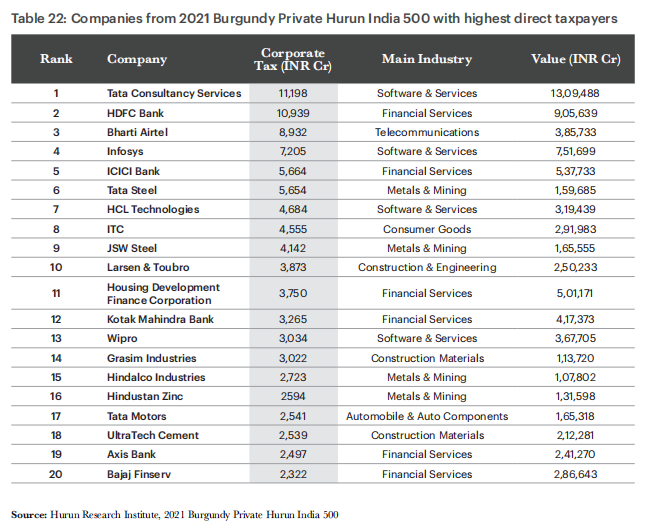

Contribution to exchequer Companies from the 2021 Burgundy Private Hurun India 500 contribute INR 1.9 lakh crore, nearly 62% of corporation income-tax collection in FY 2021.

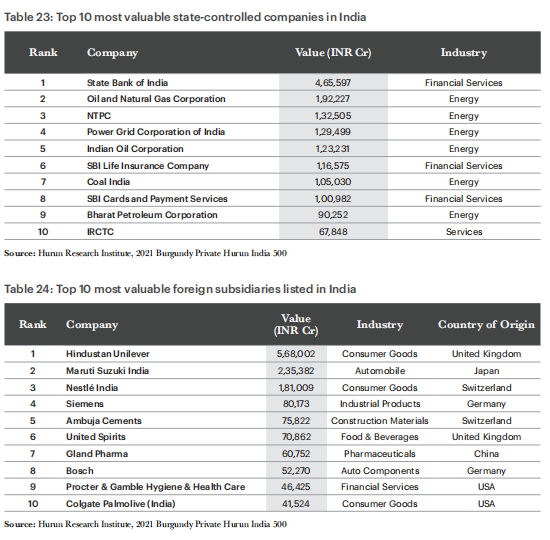

What about state-controlled companies The 2021 Burgundy Private Hurun India 500 focuses exclusively on non-state-controlled companies, meaning that state-controlled companies like SBI or ONGC are out of contention to make the list.

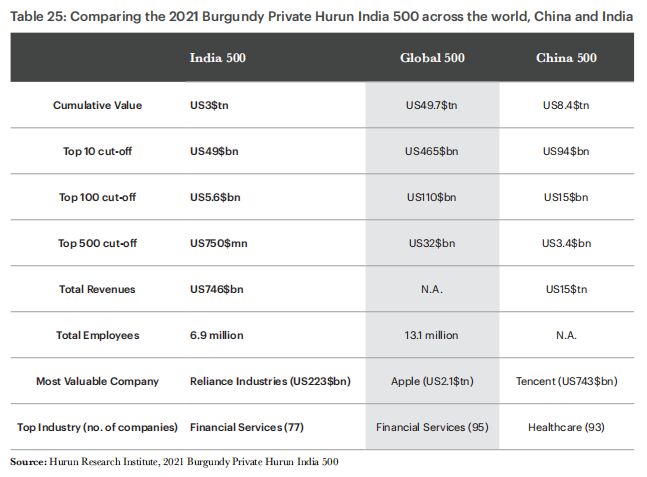

Where does 2021 Burgundy Private Hurun India 500 stand? While the 2021 Burgundy Private Hurun India 500 may look big, it is worth comparing against the Hurun Global 500 and Hurun China 500. The 2021 Burgundy Private Hurun India 500, for example, are worth a third of the Hurun China 500.

The Bootstrappers Some of the most valuable companies are ‘bootstrapped’, grown without taking external funding. Bootstrapped companies are dominated by traditional, non tech industries such as pharmaceuticals, FMCG and so on.

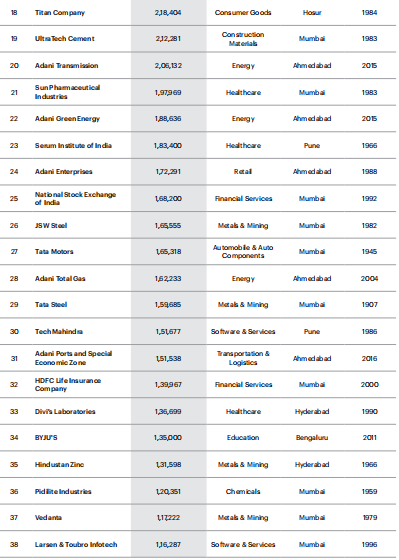

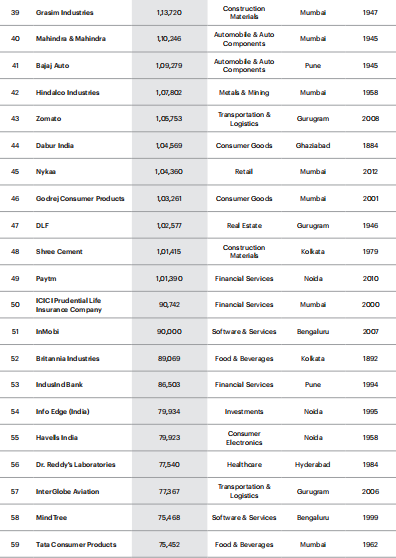

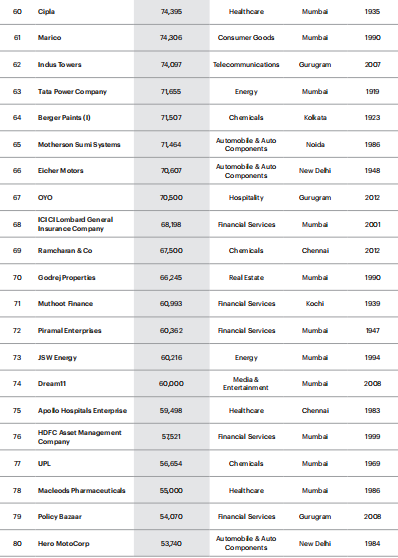

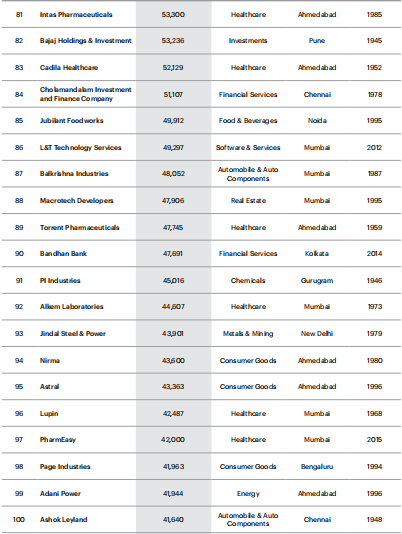

2021 Burgundy Private Hurun India 100

- END - |

Burgundy Private Hurun India 500 2021

时间:2024-04-17 03:25 来源:网络整理 转载:我的网站